Supplier Management Special Interest Group Post-Meeting Report - April 2016

The April 2016 Supplier Management Special Interest Group built on the themes from the previous session and further elaborated on the Supplier Management Framework, including a description and discussion on what “best in class” looks like as well as how to ensure effective benefits realisation from the supplier relationships that you have in place.

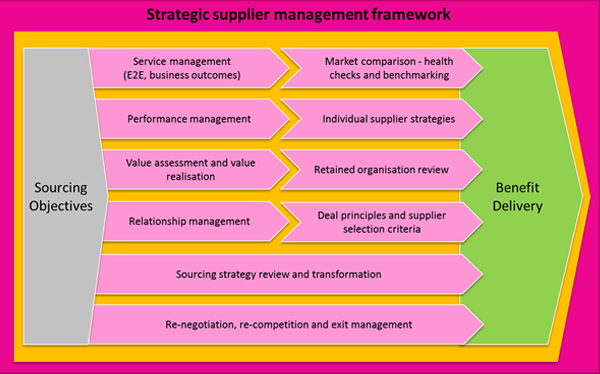

Peter presented the overall 10-point framework and explained that a ‘best in class’ strategic supplier management framework should:

- incorporate current market best practice

- cover not only the basics, such as service management, but also wider relationship and performance, including value realisation and benefit delivery

It is important to recognise that part of building a relationship is to understand what a supplier wants out of it in order that both parties can achieve their objectives. The group proceeded to discuss each of the framework components, providing comments and insight while reflecting on each element.

Framework component 1: service management

- Common SLA framework across suppliers

- End to end SLAs across all suppliers and all service components

- Move towards business outcome SLAs

- Smart incentives/penalties

Discussion points centred around having an annual review of SLAs to ensure that the business requirements were still being met, including SLAs and penalties focussed on business critical processes and also providing a “bonus” to specific employees around superior performance. It was recognised that SLA penalties are a “stick” to provide visibility of poor performance rather than provide compensation aligned with impact to business.

Framework component 2: performance management

- Wider balanced scorecard across all aspects of relationship performance, not just delivery

- Sustained good performance linked to specific benefits

- Persistent poor performance linked to specific penalties

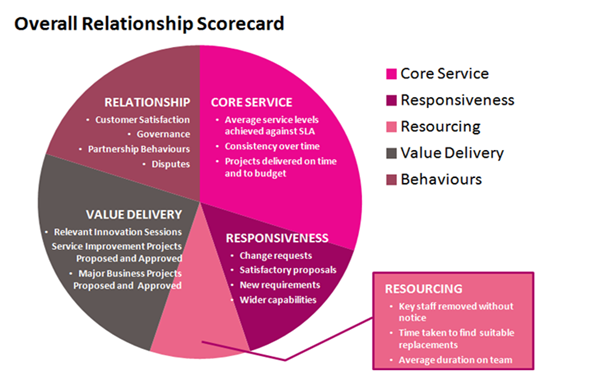

An example scorecard is shown below.

An overall relationship scorecard provides the message to your supplier that the service is not just about SLAs, but also about the overall holistic service/relationship being delivered.

When defining the scorecard, the KPIs have to be as objective as possible and it is recommended that there are around 3 or 4 in each sector.

It is recognised that behaviours will always be subjective but if limited to 1 or 2 KPIs, there is no reason why these cannot be incorporated into a contract.

Framework component 3: value assessment

It is important to understand the “value elements” being delivered by the contract, monitoring and measuring these on a frequent basis e.g.

- Reducing business cost/increasing business revenue

- Classic methods – gaining economies of scale

- Rationalising service centres

- Technology transformations by implementing new technology

- Service improvement, increasing SLAs

- Labour arbitrage

To be able to monitor the value being delivered on an ongoing basis, it is important to understand the value levers prior to contracting for the service, so that data requirements and relevant metrics can be incorporated into the contract schedules.

Framework component 4: relationship management

- Relationship quality reviewed regularly and formally at senior level

- Assessment based around the same balanced scorecard used for performance management

- Scored jointly by client and supplier

- Placed in the governance process

- Specific actions for improving the weak areas of the relationship – with a formal Relationship Improvement Plan (analogous to a formal Service Improvement Plan) if necessary

The overall governance structure and “how” the relationship is going to be managed needs to be incorporated into the contract so that both parties have a clear view of their roles and responsibilities. In addition, effective stakeholder communication is important in order for the overall governance framework to be understood by all internal employees with supplier interaction.

Framework component 5: market comparison

- Regular market comparison is required throughout the life of the relationship to maintain a quantitative view of how each supplier compares against the market

- Health checks

- Formal benchmarking

- Ad hoc market testing

The group discussed the value of benchmarking. It was seen as being useful in providing a view as to the “value” of a contract when it is coming up for renewal. It is recommended to always include a benchmarking schedule in the contract.

Many organisations sign a 5-year deal and do not carry out any market testing during that 5-year relationship. It is advisable to conduct an annual health check and raise a contract change for those elements where the existing contract does not meet the market practice.

Framework component 6: individual supplier strategies

As well as an overall sourcing strategy across the suppliers, it is very useful to have explicit individual strategies for each strategic supplier. These should:

- Be written down and agreed by all key stakeholders

- Be kept private to the client and communicated (at some level) to all key persons who are regularly dealing with the supplier. May on occasion be partially shared with the supplier

- Describe the supplier’s intended role within the overall target sourcing model

- Identify any major transformational changes required, along with timescales - for example in service delivery model (geographical, technology, etc.) or commercial model

- List any areas where improvements are sought, along with timescales - for example, service delivery, resourcing quality, innovation, value delivery or behaviours

Framework component 7: retained organisation review

The retained organisation needs to be regularly reviewed and this review should identify any changes required to the retained organisation in order to keep it ‘fit-for-purpose’ e.g.

- Functional elements - IT and technology strategy and architecture, business account management, demand management, intelligent customer, service integration (if not outsourced), supplier management and governance

- Organisation - structure and management

- Processes - procedures, interfaces, tools and documentation

- People - roles, experience, capabilities and development

- Scale - headcount and cost

The group recognised the importance of ensuring that senior management are aligned to this strategy and provided sponsorship for the review.

Framework component 8: deal principles and supplier selection criteria

A regularly updated set of strategic deal principles common across all strategic suppliers which should:

- Cover all areas of the supplier relationship - service, resourcing, commercial, contractual, relationship, governance and communication

- Reflect the changing requirements and priorities of the business

- Track current market best practice in terms of what is most beneficial and effective for the customer yet still acceptable to most suppliers under normal competitive pressure

- The group discussed that it would be “evolutionary” to move to this structure, but agreed that having a framework in place and ensuring that all future relationships incorporated the principles was important.

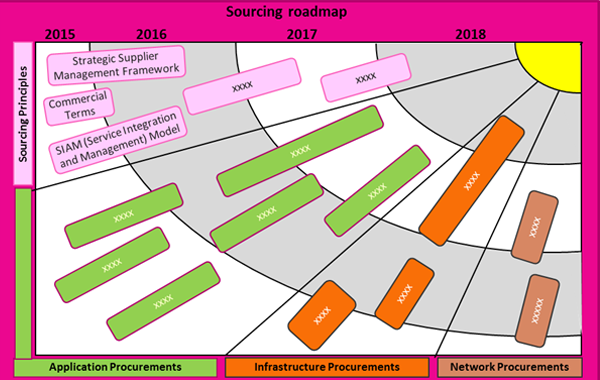

Framework component 9: Sourcing strategy and sourcing transformation

- Overall strategy should be reviewed regularly

- Ensure the strategy reflects where you are as a business

- Sourcing model should articulate the chosen strategic options along each of the key dimensions of sourcing strategy

A sourcing implementation plan needs to be developed, regularly updated and followed, which is:

- Designed to move from current situation to new sourcing model as soon as possible

- Phased for quick wins and maximum early benefit delivery

- Compatible with key contract dates and other parallel initiatives

Framework component 10: renegotiation/re competition and exit

- All strategic relationships should be fully re-negotiated, and where appropriate re-competed, on a regular basis

In our experience, many incumbent relationships are renewed without full negotiation. To enable your relationships to remain competitive and add value, it is important to define a re-negotiation strategy and provide a “step up” opportunity to the supplier to meet the requirements. It is costly to the incumbent supplier to have to re-bid for existing work.

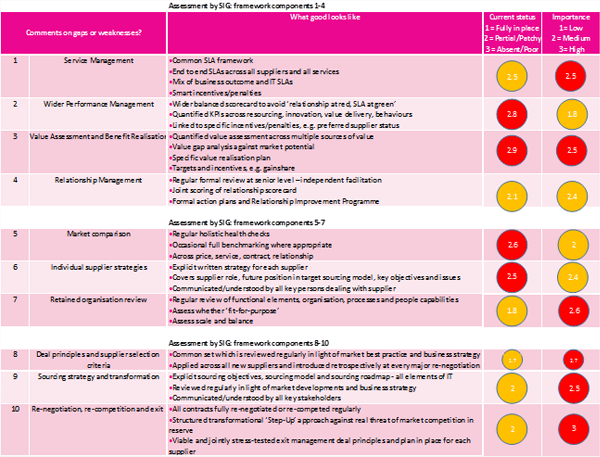

Each participant in the meeting scored themselves against each element of the framework and also rated the importance of the element. The combined scoring is detailed below.

The scores enabled participants to gain a view as to the areas they needed to focus on and using the materials and information provided at the group, they would be able to put a plan in place to address those areas of weakness.

General comments from the participants are detailed below:

- One participant found it difficult to score their organisation due to there not being a dedicated supplier management function in place

- Another participant also did not have a dedicated supplier management function and explained that one of the purposes of attending the SIG was to better understand the benefits

- One other participant does not have a mature supplier management function and currently no contract owners. They have just completed supplier segmentation, between tier one and tier two suppliers, and are now putting in place some level of governance

- IT procurement used to be a passive role in one organisation; the participant now sits outside of function in a dedicated procurement team

- One organisation has a supplier management framework in place but it has deteriorated due to focus on cost cutting. The implication on the supplier when they are “downgraded” to a B/C supplier was also discussed

- It is important to understand the wants and needs of the supplier, their agenda and how they work to enable a “best in class” relationship to exist. The more tools you can provide your supplier, the better they can work for you

Due to the amount of debate and discussion around the supplier management framework, the group briefly touched on the topic of Supplier Management as a Function, including the benefits and drawbacks, but were unable to go into detailed discussion. This will be covered at the next meeting.

Quantum Plus would like to thank all participants for their contributions on the day. If you would like to have any further information on the Supplier Management Framework, be in a position to score your department and put in relevant action plan to address areas of weakness or wish to be involved in the next session, please contact Lesley Michaelis at lesley.michaelis@quantumplus.co.uk. We look forward to welcoming you.